The copyright market is known for its wild fluctuations, sometimes feeling like a volatile ride. This chaos can be frightening for even the most experienced investors. It's crucial to remember that emotional decisions are rarely the best course of action. Instead, a disciplined approach is key to coming out on top. Develop a solid investment strategy that aligns with your investment goals, and remain steadfast even when the market sputters. Remember, long-term growth often come from persistence

The Future of Finance : The Future of Finance in copyright

copyright is revolutionizing the realm of finance, click here offering a pathway towards a decentralized future. Say are the days of centralized financial institutions dominating the flow of funds. Instead, blockchain are empowering individuals to transact directly with each other, cutting out the intermediary.

- This transformation is driven by the promise of transparency, safety, and efficiency.

- Picture a world where financial services are accessible to the global population, regardless of their geography or financial background.

- That is the dream of decentralized finance, a future where individuals own their own wealth.

With copyright ecosystems continue to evolve, we can anticipate even more disruptive applications that will reshape the financial sector.

Mastering the copyright Maze: A Beginner's Guide to Trading

Diving into the dynamic world of copyright trading can seem like jumping on a wild expedition. But with the right strategies, you can conquer this intricate maze and possibly turn your investment into profit. First, it's crucial to understand the fundamentals of cryptocurrencies. Research into different tokens, their systems, and the factors that drive their worth.

- Craft a Solid Trading Plan: A well-defined trading strategy will direct your decisions and help you minimize downsides. Consider factors like your risk tolerance, investment objectives, and the period of your investment.

- Choose a Reputable Exchange: Selecting a reliable copyright exchange is paramount. Look for platforms that are protected, regulated, and offer diversity of trading opportunities.

- Begin Gradually: Don't allocate more than you can afford to lose. Step-by-step increase your investment as you gain experience.

Stay Informed: The copyright market is continuously evolving. Monitor industry news, trading signals, and regulatory updates to arrive at informed choices.

The Bitcoin Boom: Unlocking the Potential of Blockchain Technology

The explosion of Bitcoin has captured global attention, but its impact extends far beyond just a digital medium. At its core lies blockchain technology, a revolutionary platform with the potential to transform industries and reshape our online world. This decentralized and transparent ledger offers unparalleled security, enabling secure transactions and fostering confidence. From supply chain tracking to voting systems, the applications of blockchain are limitless. As we delve deeper into this era of digital transformation, understanding the power of blockchain is vital for navigating the future.

Altcoin Adventures: Exploring Beyond the Big Players

The blockchain world is a vibrant ecosystem, and while Bitcoin leads, there's a whole universe of other cryptos waiting to be unveiled.

Daring investors are constantly searching for the next big gem, venturing into the nooks and crannies of the market to find hidden potential. These cryptocurrencies often offer innovative features, technologies, or use cases that differentiate them from the established players.

With decentralized finance (DeFi) protocols to NFTs, the panorama of altcoins is incredibly varied.

It's a voyage that requires due diligence, but the rewards can be truly outstanding. So, if you're ready to embark on an altcoin adventure, remember to always do your homework.

copyright Trading Strategies: From Day Trading to Long-Term Holding

The dynamic world of cryptocurrencies offers diverse of trading strategies to suit various risk appetites and financial goals. Beginners often gravitate towards long-term holding, a strategy that involves purchasing and retaining assets for an extended period, hoping for future price appreciation. Conversely, experienced traders may delve into day trading, characterized by frequent deals within a single day to capitalize on short-term price fluctuations. Another popular approach is swing trading, where traders hold assets for several days or weeks, aiming to profit from intermediate-term price swings. Finally, the optimal strategy depends on your individual risk tolerance, time commitment, and market analysis skills.

- Day trading requires constant observation and a deep understanding of technical analysis.

- Swing trading involves identifying entry and exit points based on chart patterns and market momentum.

- Long-term holding is a buy-and-hold strategy that requires patience and faith in the long-term growth potential of cryptocurrencies.

James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Susan Dey Then & Now!

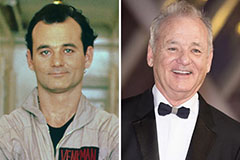

Susan Dey Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!